Money: Tony Robbins - Summary & Analysis (1/6)

Money: Master the Game walks you through 7 simple steps you can take to ensuring total financial freedom.

Part 1: Welcome to the Jungle: The Journey Begins with this First Step.

Chapter 1.1: It’s Your Money! It’s Your Life! Take Control.

Money is vital and crucial but not paramount. It’s simply a tool, a source of power used in service of others and a life well lived.

“Money is a good servant but a bad master”

Others are consumed with such a hunger for money that it destroys them and everyone around them. Some are even willing to give up things that are far more valuable to get it: their health, their time, their family, their self-worth, and, in some cases, even their integrity.

At its core, money is about power.

We all know that on some level it’s an illusion. Money isn’t even gold or paper today, it’s zeros and ones in banking computers. What is it? It’s like a shape-shifter or a canvas, assuming whatever meaning or emotion we project on it.

In the end, money isn’t what we’re after . . . is it? What we’re really after are the feelings, the emotions, we think money can create:

Money is certainly one of the ways we can turn the dreams we have into the reality we live.

But even if money is just a perception — an abstract concept — it doesn’t feel that way if you don’t have enough of it! And one thing is for sure: you either use it, or it uses you. You either master money, or, on some level, money masters you!

How you deal with money reflects how you deal with power. Is it an affliction or a blessing? A game or a burden?

Games are a reflection of life. Some people sit on the sidelines, and some play to win. How do you play? The Money game is a game that you and your family can’t afford to lose.

Just imagine what life would be like if you had mastered this game already.

What if money didn’t matter?

How would you feel if you didn’t have to worry about going to an office every morning, or paying the bills, or funding your retirement? What would it be like to live your life on your own terms? What would it mean to know you had the opportunity to start your own business, or that you could afford to buy a home for your parents and send your kids to college, or have the freedom to travel the world?

How would you live your life if you could wake up each day knowing there was enough money coming in to cover not only your basic needs but also your goals and dreams?

The truth is, a lot of us would keep working, because that’s the way we’re wired. But we’d do it from a place of joy and abundance. Our work would continue, but the rat race would end. We’d work because we want to, not because we have to.

That’s financial freedom.

The secret to wealth is simple: Find a way to do more for others than anyone else does. Become more valuable. Do more. Give more. Be more. Serve more. And you will have the opportunity to earn more.

You have to make the shift from being a consumer in the economy to becoming an owner — and you do it by becoming an investor. People who succeed at the highest level are not lucky; they’re doing something differently than everyone else does.

“The secret to getting ahead is getting started”

When you lack confidence about money, it unconsciously affects your confidence in other areas too.

One of the great gifts of “mastering the game” is not only being able to win but to have enough to make a difference for others. No matter how difficult our situation may be, there are always people who are suffering more. When someone creates wealth, it’s his or her privilege, and, I believe, his or her responsibility, to give back to those who are just beginning the journey or those who have experienced tragedies that have knocked them off the path.

The reward is that if you give, even at the times when you think you have very little, you’ll teach your brain that there is more than enough. You can leave scarcity behind and move toward a world of abundance.

Chapter 1.2: The 7 Simple Steps to Financial Freedom — Create an Income for Life.

Anticipation is the ultimate power. Losers react; leaders anticipate.

Death and taxes: the only constants.

We all know the drag of taxes, to some degree, but few realize just how big a bite taxes take from our ability to achieve financial freedom. Sophisticated investors have always known this: it’s not what you earn, it’s what you keep that matters.

We know we need to save more and invest. So why don’t we do it? What’s holding us back?

Let’s start by admitting that human beings don’t always act rationally. Some of us spend money on lottery tickets even if we know the odds of winning the Powerball jackpot are 1 in 175 million, and that we are 251 times more likely to be hit by lightning ⚡️.

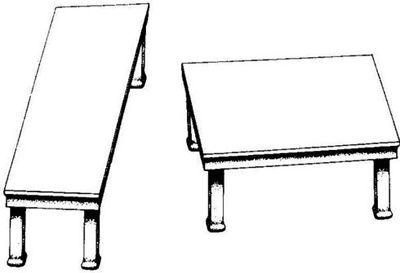

Human beings evolved to depend on our sight, and a huge part of our brain is dedicated to vision. But how often do our eyes deceive us? Have a look at the two tables below.

If I asked you which table is longer, the narrow one on the left or the fat one on the right, most people would naturally pick the one on the left. And if you were one of them, you’d be wrong. The lengths of both tables are exactly the same.

So if we make these mistakes with vision, which in theory we’re decent at, what’s the chance that we don’t make even more mistakes in areas we’re not as good at—financial decision making, for example? Whether or not we think we make good financial decisions, or poor ones, we assume we’re in control of the decisions we do make. Science would suggest we’re not.

Information without execution is poverty. We’re drowning in information, but we’re starving for wisdom.

True mastery requires three levels:

The first is cognitive understanding. It’s your ability to understand the concept. Any of us can get it. Information by itself isn’t valuable. It's only the first step.

You start getting real value when you reach the second step: emotional mastery. That’s where you have heard something with enough repetition, and it’s stimulated enough feelings inside you — desires, hungers, fears, concerns — that now you become conscious and capable of consistently using what you’ve learned.

But the ultimate mastery is physical mastery. That means you don’t have to think about what you do; your actions are second nature. And the only way to get it is through consistent repetition.

“I don’t believe people are looking for the meaning of life as much as they are looking for the experience of being alive.”

Chapter 1.3: Tap the Power: Make the Most Important Financial Decision of Your Life.

Our earned income will never bridge the gap between where we are and where we really want to be. Because earned income can never compare to the power of compounding!

No matter how much you earn, you’ll find a way to spend it. You have to take control and harness the exponential power of compounding. It will change your life! You have to move from just working for money to a world where money works for you.

You’re already a financial trader. You might not think of it in just this way, but if you work for a living, you’re trading your time for money. Frankly, it’s just about the worst trade you can make. Why? You can always get more money, but you can’t get more time.

The ultimate ATM.

You’ve set things up so that you give away what you value most (time) in exchange for what you need most (income) — and if you recognize yourself in this description, trust me, you’re getting the short end of the deal.

If you stop working, you stop making money. So let’s take you out of the equation and look for an alternative approach. Let’s build a money machine to take your place — and, let’s set it up in such a way that it makes money while you sleep.

As you can see, the “machine” can’t start working until you make the most important financial decision of your life.

The decision?

What portion of your paycheck you get to keep. How much will you pay yourself — off the top, before you spend a single dollar on your day-to-day living expenses?

How much of your paycheck can you (or, more importantly, will you) leave untouched, no matter what else is going on in your life?

I really want you to think about this number, because the rest of your life will be determined by your decision to keep a percentage of your income today in order to always have money for yourself in your future.

The money you set aside for savings will become the core of your entire financial plan. Don’t even think of it as savings! I call it your Freedom Fund, because freedom is what it’s going to buy you, now and in the future.

☝️Save a fixed percentage each pay period, and then invest it intelligently, and over time you’ll start living a life where your money works for you instead of you working for your money.

I call it your money machine because if you continue to feed it and manage it carefully, it will grow into a critical mass: a safe, secure pile of assets invested in a risk-protected, tax-efficient environment that earns enough money to meet your day-to-day expenses, your rainy-day emergency needs, and your sunset days of retirement spending.

Imagine a bucket you’ll fill with your investment savings. You’ll put money into it every pay period — a set percentage that you get to determine. Whatever that number is, you’ve got to stick to it. In good times and bad. No matter what.

Why? Because the laws of compounding punish even one missed contribution.

Don’t think of it in terms of what you can afford to set aside —that’s a sure way to sell yourself short. And don’t put yourself in a position where you can suspend (or even invade) your savings if your income slows to a trickle some months and money is tight.